|

|||||||||

Instant Home Searches

Quick Links |

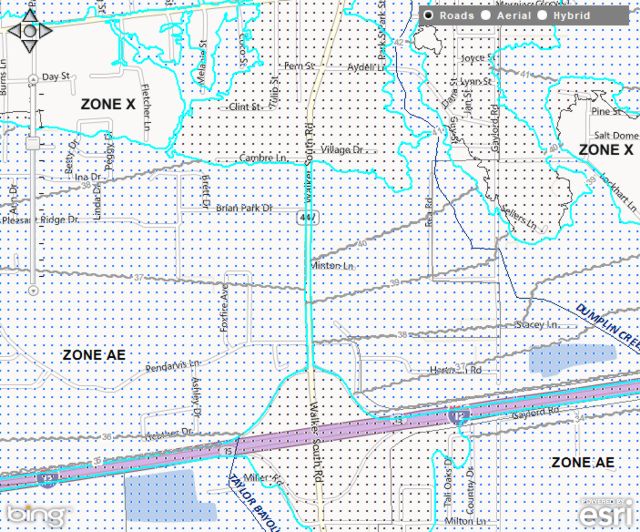

On the

right is part of the flood map for the city of Walker,

LA. This was taken from the flood mapping

site we use all

the time, and which also appears under our “Quick

Links” section on the left. While it may look

complicated, this is fairly representative of a typical

flood map. You can see sections which are clear (zone X),

sections which are shaded with blue dots (zone AE), and

sections which are shaded with gray dots (zone B). Each

of these colors represents a different flood zone

classification. As you can see, they follow the contours

of the land, and can lie in close proximity to one

another. On the

right is part of the flood map for the city of Walker,

LA. This was taken from the flood mapping

site we use all

the time, and which also appears under our “Quick

Links” section on the left. While it may look

complicated, this is fairly representative of a typical

flood map. You can see sections which are clear (zone X),

sections which are shaded with blue dots (zone AE), and

sections which are shaded with gray dots (zone B). Each

of these colors represents a different flood zone

classification. As you can see, they follow the contours

of the land, and can lie in close proximity to one

another.While there are many different flood zone classifications, we will deal with those which are most commonly encountered. (For a full tutorial on flood zones, click here.) Flood zone A or AE: These designations are for areas of higher flood risk, which are considered to have a likelihood of flooding once every 100 years, thus an annual probability of 1%. These are what are commonly known as “flood zones”, because lenders require that properties in these zones have flood insurance. Officially they are called “Special Flood Hazard Areas”. Flood zone B: This designation denotes areas considered to have a likelihood of flooding once every 500 years, thus an annual probability of 0.2%. I have also seen these areas referred to as zone X500. Flood zone X or C: These are the best flood zone classifications. They represent areas considered to be subject to flooding less than once every 500 years. Flood insurance is not required for properties located in zones B, X500, X, or C. However, as we discussed in part 1 of our series on flood insurance, it is possible for any location to experience a flood, so we firmly believe that flood insurance should always be carried. Outside of Special Flood Hazard Areas, the cost of flood insurance is very inexpensive. Our house, which was utterly destroyed by the floodwaters of Hurricane Katrina, was located in flood zone C! Thankfully, we had flood insurance. Also on the sample map, within the AE zones, you can see gray wavy lines with a number on them. These indicate the approximate Base Flood Elevations (BFE). Think of the BFE as being the surface of the floodwaters if it were to flood. BFE is expressed as a height in feet above sea level. The exact BFE for a specific location is determined by a surveyor. Base Flood Elevation is a crucial factor in calculating the cost of flood insurance for properties located in Special Flood Hazard Areas. In our next discussion, we will look at how flood insurance rates are determined. Greg and Danielle |

||||||||

| Did you find this topic

informative? If so, then click

to share it on Facebook. |

|||||||||

All images and

content Copyright © 2013 Greg and Danielle Bunch. All

rights reserved. |

|||||||||